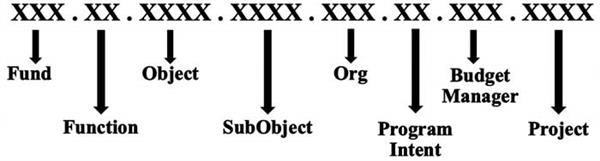

Account Code Structure

-

Section 44.007 of the Texas Education Code (TEC) requires that a standard school district fiscal accounting system be adopted by each school district.

The system must meet at least the minimum requirements prescribed by the State Board of Education and also be subject to review and comment by the state auditor. Additionally, the accounting system must conform with Generally Accepted Accounting Principles (GAAP). The Financial Accountability System Resource Guide (FASRG) describes the rules of financial accounting for school districts and can be found on the Texas Education Agency's website here. A brief introductory to this can be found below.

The following elements are reported to the Texas Education Agency (TEA) through the Public Education Information Management System (PEIMS) data submissions.

Fund - Who is funding the budget?

Function - Why is the money being expensed?

Object - For what is the money being expensed?

Organization - Where are the funds being expensed (which Campus or Administrative Org)?

Program Intent - For whom are the funds being expensed (particular need or student group)?TEA allows districts to define particular elements locally, which are used to provide additional details for financial transactions.

SubObject - Typically used to track a variety of programs or initiatives, but can also be used to further define the Object.

Budget Manager - Identifies the Campus Principal or Department responsible for budgeting , maintaining and assuring that funds are used properly to meet the goals of the District.

Project - Identifies a particular program or initiative not defined by the SubObject.Additional details for each element can be found in the information that follows.